The New Reality of Investment

As we find ourselves entrenched in an era characterized by rampant monetary expansion and fiscal irresponsibility, the notion of the debasement trade has emerged as a focal point for investors seeking refuge from inflationary pressures. With central banks worldwide aggressively injecting liquidity, the traditional paradigms of investing are being upended.

Gold: The Timeless Hedge

Historically, gold has been the bastion of safety in turbulent economic times. Its intrinsic value and global acceptance make it a go-to asset for wealth preservation. Despite the fluctuations and debates about its role in modern finance, it remains a critical component for any portfolio concerned about currency debasement.

In recent years, those savvy enough to position themselves in gold have reaped the rewards. As paper currencies lose purchasing power, gold stands resilient, offering both a hedge and a potential for appreciation. It is not merely about timing the market; it’s about recognizing gold’s perennial strength as a safeguard against the unpredictable whims of policymakers.

Bitcoin: The Digital Gold?

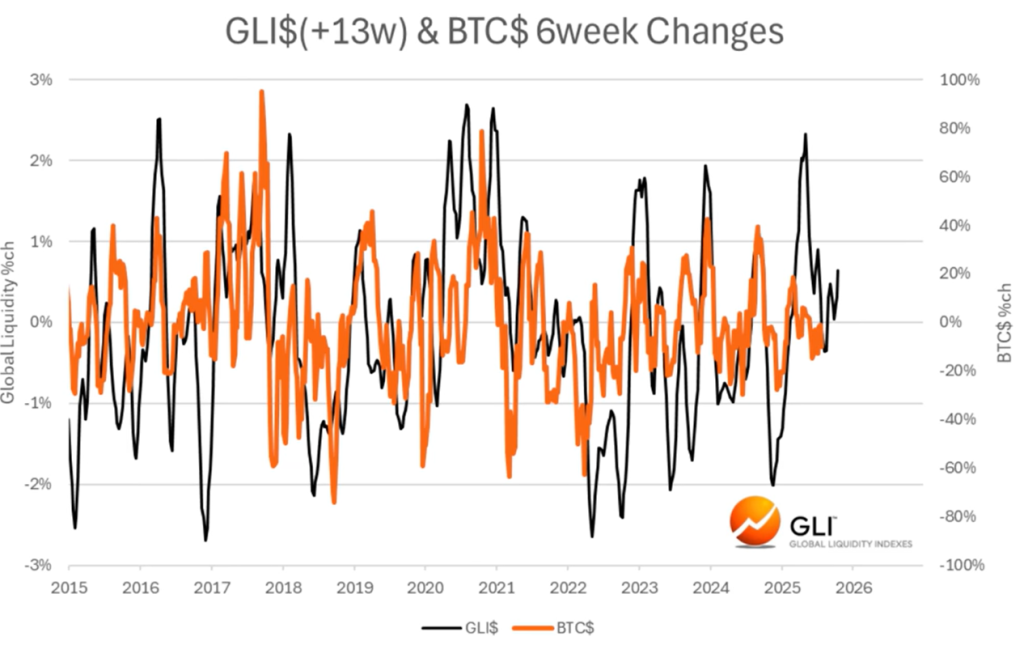

In the age of technology, Bitcoin has garnered attention as a potential alternative to gold. With its design aimed at scarcity and its independence from any central authority, Bitcoin appeals to a demographic wary of fiat currencies. The connection between liquidity and Bitcoin prices cannot be ignored. Recent analyses have shown that Bitcoin reacts dramatically to changes in global liquidity, underscoring its role as both a speculative asset and a potential inflation hedge.

However, despite its attractiveness, one must tread carefully. Bitcoin’s volatile nature poses risks that should not be underestimated. Those who believe in its future should view it as part of a diversified strategy rather than a wholesale replacement for traditional hedges like gold.

The Debasement Trade: A Tactical Overlay

As we ponder our investment strategies amidst these evolving dynamics, the debasement trade becomes more than a mere concept, it provides a tactical framework for asset allocation. While the core of one’s portfolio should be rooted in tangible, inflation resistant investments like gold and high quality equities, there is merit in employing tactical overlays that respond to cyclical shifts.

The tactical sleeve might include a variable allocation to Bitcoin, where a thoughtful approach emphasizes timing and market sentiment. How much of one’s assets should be in this emerging digital frontier? It’s a personal choice, dictated by individual risk profiles and financial goals.

The Dollar and Cross Border Dynamics

Against this backdrop, the U.S. dollar must not be overlooked. Historically, it has been the linchpin of global liquidity flows, drawing investments from all corners of the globe. Yet, with rising tensions and a growing skepticism about America’s fiscal future, some investors are questioning the dollar’s long term supremacy.

The narrative surrounding capital flows has evolved, with potential outflows being inhibited by a complex web of geopolitical factors. As trade wars and tariff discussions permeate the conversation, understanding these dynamics will be imperative for those navigating the waters of international investments.

Charting the Course Ahead

In conclusion, the landscape of investing amidst the debasement trade requires a blend of traditional wisdom and modern adaptability. While gold remains a critical pillar, the allure of Bitcoin as a digital hedge offers a contemporary twist to investment strategies.

Embrace the tactical overlay, and ensure your portfolio is well-positioned to weather the storms of inflation and market volatility. In these uncertain times, the fusion of age-old investment principles with the embrace of innovative assets will yield resilience and opportunity alike. As we proceed, let’s remain vigilant, adaptive, and most importantly, informed.

In the old Wall Street spirit, it’s time to make decisions grounded in both caution and opportunity. The game is afoot adapt or be left behind.

Leave a Reply

You must be logged in to post a comment.